Some pundits and politicians have blamed Joe Biden for our economy’s high inflation rate, but the facts tell a different story.

The primary causes of the recent surge in our inflation rate were Covid-19, the Russian invasion of Ukraine, corporate greed (or good business decisions), and something no politician has mentioned: excessive government and private debt.

Debt doesn’t cause inflation. What does, is increasing a country’s money supply faster than its supply of goods and services is growing.

M2, the Federal Reserve Bank’s (FRB) measure of our money supply, includes savings and other financial instruments that are cash equivalents. However, M2 does not include available credit, which is as spendable as cash. Unfortunately, unlike cash, available credit eventually changes into debt.

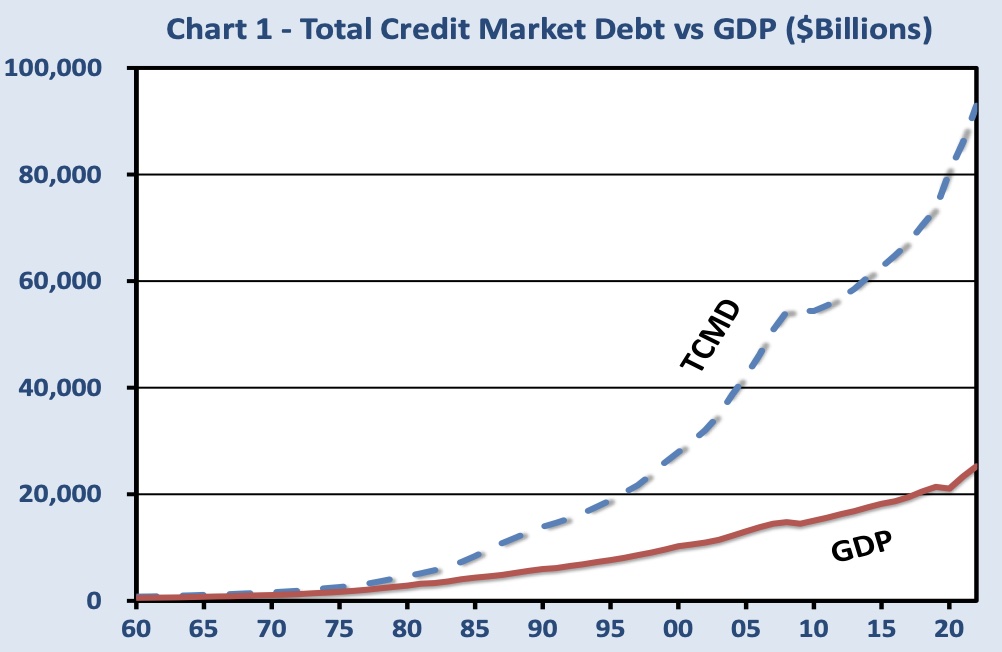

On Chart 1, Total Credit Market Debt (TCMD) is the sum of government and private debt, which has been growing much faster than GDP since the early 1980s. TCMD is a crucial measure because excessive private-sector debt is as damaging to our economy as too much government debt.

Lessons learned from economic history about excessive debt are:

Fear of Covid-19 in 2020 and resulting lockdowns disrupted normal business processes worldwide. Shortages of products, materials, employees, and transportation capacity developed in global supply chains, causing sales, profits, jobs, and millions of paychecks to drop like rocks.

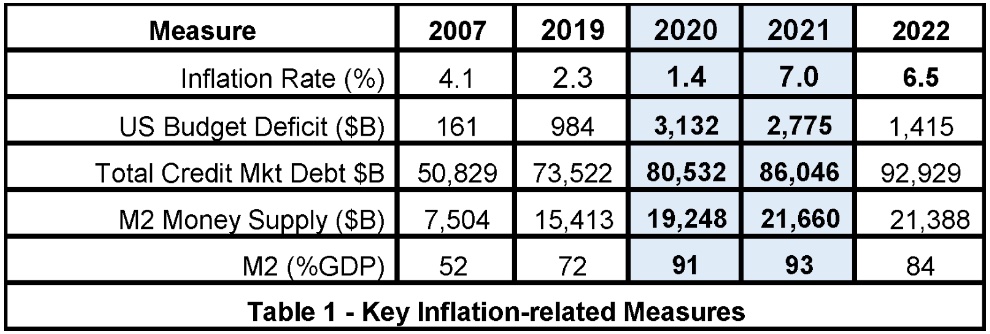

To hopefully disarm Covid-19, prevent an economic meltdown, and restore economic growth, the Trump and Biden administrations passed spending bills that created enormous budget deficits of $3,132 billion in 2020 (Trump) and $2,775 billion in 2021 (Biden). Most of the outlays were well-intended, but done in haste under challenging circumstances. Some waste was unavoidable in combatting Covid-19, but both administrations used the pandemic as an opportunity to reward cronies and try to buy votes.

When Covid-19 was finally under reasonable control in early 2021, eager consumers armed with ample savings, free government money, and cheap credit charged into our struggling economy, where more demand than supply quickly raised prices on many goods and services.

The next big boost to inflation was the Russian invasion of Ukraine in February 2022. The war drastically reduced supplies of oil, fuels, grains, fertilizer, and other essential products, increasing the prices of almost everything everywhere.

As soon as inflation became a hot topic on the evening news, many producers, distributors, and retailers used it as cover for raising their prices significantly more than their costs. Some call it good business decisions; others call it greed.

Mark Zandi, the chief economist of Moody’s Analytics, estimated Covid-19 added 2.0%, the Ukraine war added 3.5%, and Biden’s spending added 0.1% to our underlying inflation rate of 2.3%.

Zandi’s numbers say Covid-19’s damage to our economy and the Ukraine war caused almost all the increase in our inflation rate, not Biden’s American Rescue Plan. It seems that anyone paying attention to what was happening in our world in 2022 would reach the same conclusion without doing any complicated analysis.

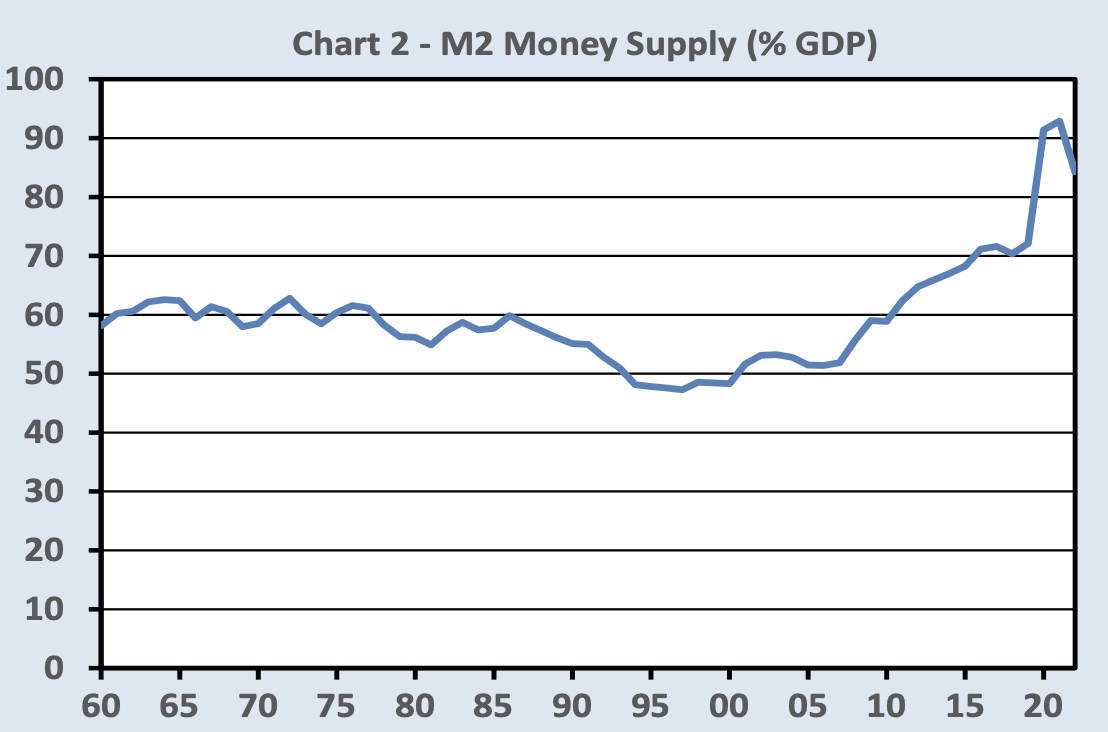

Chart 2 shows how our money supply’s growth rate accelerated after the Great Recession when the FRB tried to “stimulate” our economy with borrowed money and money created out of thin air.

The result was M2 increased from 52%GDP in 2007 to 72%GDP in 2019.

Going into the 2020s, we had all the ingredients for creating rapidly increasing prices: a historically colossal money supply; hordes of eager-to-buy customers with plenty of cash and credit; shortages of many goods, services, and employees; and vendors anxious to recover sales and profits lost during the Covid-19 lockdowns.

As expected by some analysts, our annual inflation rate increased from 1.4% in 2020 to 7.0% in 2021.

Table 1 shows how TCMD and M2 shot up in 2020 and 2021 from huge Federal budget deficits that gave free money to businesses, organizations, and individuals to boost our economy.

The record deficit spending increased GDP 10.7% in 2021, but it also increased M2 26% in 2020. Is it any wonder that inflation exploded in 2021?

Joe Biden didn’t develop Covid-19 in his garage, didn’t create the post-pandemic supply chain problems, didn’t ask the Russians to invade Ukraine, and didn’t tell businesses to gouge their customers by raising their prices far more than their costs.

And Joe Biden didn’t export inflation to other countries around the world.

Anyone who wants to blame Biden for inflation should also blame Trump, the senior politicians of both political parties, and the Federal Reserve Bank for decades of fiscal incompetence and irresponsibility.

The data and historical record say the fundamental causes of our high inflation rate were:

The increase in government spending and massive budget deficits by Trump and Biden were apparently the straws that broke the camel’s back. If the camel (our economy) wasn’t already buried under a mountain of private and government debt when the straws landed, the increase in our inflation rate would certainly have been considerably smaller.

Have a comment? Send it here.

Please tell anyone who might be interested in learning critical truths about our economy, government, and society to visit:

This article was conceived, researched, and written by a real human being who accepts responsibility for any errors and welcomes constructive criticism.

© 2024 The Real State of the Union, All rights Reserved